Insurance for Snowbirds and Seasonal Drivers: Coverage When You're Away

Insurance for Snowbirds and Seasonal Drivers: Coverage When You're Away

The open road beckons, especially when the weather turns cold. If you’re a "Snowbird" migrating south for the winter, or a seasonal driver who leaves a vehicle parked for extended periods, you might assume your standard car insurance policy has you covered. However, managing auto insurance when you spend significant time away from your primary residence requires careful planning to ensure you maintain adequate coverage without overpaying.

Here is a comprehensive guide to navigating car insurance for seasonal drivers and Snowbirds.

Understanding the Snowbird Dilemma

Snowbirds typically face two primary insurance challenges:

- The Vehicle Left Behind: How to insure the car stored at your northern home while you are gone.

- The Vehicle Taken South: Ensuring your coverage remains valid and compliant with the laws of your temporary southern state (or country, like Mexico or Canada).

Key Takeaway: Residency Matters

Insurance rates and requirements are heavily tied to your primary residence (where your vehicle is principally garaged). When you relocate for months, even temporarily, you must inform your insurer to avoid potential claim denials.

1. Insuring the Vehicle Left Behind (Storage Coverage)

If you leave a vehicle parked and unused for several months, paying for full comprehensive and collision coverage might seem unnecessary. Fortunately, most insurers offer options to significantly reduce your premium while keeping the vehicle protected.

Option A: Comprehensive-Only Coverage

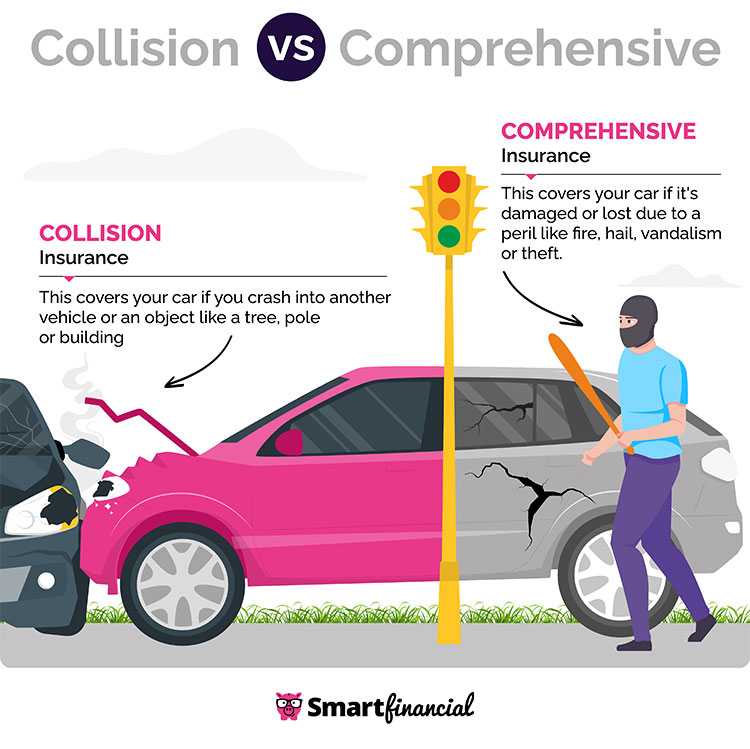

This is the most common and recommended solution for stored vehicles. You temporarily remove Collision and Liability coverage, but retain Comprehensive coverage. Why?

- Comprehensive Coverage: Protects against non-driving incidents like theft, vandalism, fire, falling objects, and severe weather damage (e.g., hail or tree limbs).

- Liability and Collision: Since the car is not being driven, these high-cost coverages are suspended, leading to substantial savings.

Crucial Note: Before driving the vehicle again, you must contact your insurer to reinstate Liability and Collision coverage. Driving without required liability insurance is illegal.

Option B: Usage-Based Insurance (If Available)

Some companies offer programs that track mileage. If your car sits idle, these programs may automatically adjust your premium down, though this is less common for long-term storage than the Comprehensive-Only approach.

2. Insuring the Vehicle You Take South

When you drive your car to your seasonal residence, your existing policy generally travels with you. However, there are state-specific nuances to consider.

State-to-State Coverage

Your existing policy should cover you anywhere in the United States and usually Canada. However, minimum liability requirements vary by state (e.g., Florida vs. Michigan). While your home state policy typically satisfies the legal requirements of the state you are visiting, it’s wise to review your coverage limits.

- Higher Limits: If you are traveling to a state known for high accident settlements, consider temporarily increasing your liability limits for added protection.

The "Primary Residence" Rule

If you spend more than six months and one day in your southern location, that location may legally become your primary residence. This triggers potential changes in vehicle registration, licensing, and, crucially, insurance requirements. Failing to update your insurer about a change in primary residence could jeopardize future claims.

3. International Travel: Coverage in Mexico

Many Snowbirds travel to Mexico. This is where standard U.S. and Canadian policies hit a major roadblock.

U.S. Auto Insurance is Invalid in Mexico

Standard U.S. auto insurance policies are generally not recognized by Mexican authorities. If you are involved in an accident, Mexican law requires proof of liability coverage issued by a Mexican insurer.

The Solution: Mexican Tourist Auto Insurance

If driving across the border, you must purchase a separate, short-term policy from a company licensed to operate in Mexico. These policies provide:

- Mexican Liability Coverage: Essential for legal compliance.

- Physical Damage Coverage: Often covers damage to your vehicle while driving in Mexico (check if your U.S. policy offers any limited coverage for this, though it’s rare).

4. Tips for Communicating with Your Insurer

Open communication with your insurance provider is the single most important step for seasonal drivers.

Before You Leave:

- Notify Your Agent: Tell them the dates you will be away and the location where the vehicle will be stored.

- Adjust Coverage: Request the temporary removal of Collision and Liability coverage on the stored vehicle (moving to Comprehensive-Only).

- Confirm Coverage Limits: Review the limits on the vehicle you are taking south, ensuring they meet your comfort level for the duration of the trip.

- Provide Contact Information: Ensure your insurer has a reliable way to reach you at your seasonal address.

When You Return:

Call your insurer immediately upon returning to your primary residence to reinstate full coverage (Liability and Collision) on the stored vehicle. Do this before you take the car out for its first drive.

5. Other Considerations for Seasonal Drivers

Non-Owned Auto Liability

If you sell your northern vehicle entirely and rely on renting cars or borrowing vehicles while you are away, consider maintaining a "Non-Owned Auto Liability" policy. This protects you against liability claims if you injure someone while driving a vehicle you don't own.

Homeowner's/Renter's Insurance

If you are storing your car in a garage attached to your home, ensure your homeowner's policy covers damage to the structure or contents while the property is vacant. Most policies require notification if the home will be unoccupied for more than 30 or 60 days.

Conclusion

Being a Snowbird or seasonal driver offers freedom and escape, but it adds complexity to managing your auto insurance. By proactively communicating with your insurance agent and adjusting your coverage to reflect the true usage (or non-usage) of your vehicles, you can enjoy significant premium savings while maintaining essential protection against the unexpected, whether your car is parked in a snowy garage or cruising the sunny coastline.

Ready to Save on Your Car Insurance?

Get personalized quotes from top Pennsylvania providers in just 2 minutes.

Get My Quote Now →Related Articles

About CheapCarInsurancePennsylvania.com

We're dedicated to helping Pennsylvania drivers find affordable car insurance coverage. Our team of insurance experts provides comprehensive guides, tips, and comparisons to help you make informed decisions about your auto insurance needs.

Disclaimer: CheapCarInsurancePennsylvania.com is an insurance lead generation service. We are not an insurance company and do not sell insurance policies directly. We connect consumers with insurance providers and may receive compensation for qualified leads.